Emmy Noether Group – Peripheral Debt: Money, Risk and Politics in Eastern Europe

People | Blog | News | Cooperation Partners

Since the 1980s, household debt has grown rapidly around the world as a result of stagnating real wages, financial deregulation, changing business strategies of banks, and other factors. Scholars in various disciplines analyse this trend as part and parcel of a wider process of “financialization” – a transformation of capitalism under the increasing dominance of global finance. Deepening indebtedness is a key mechanism that extends the reach of financialization into the intimate and domestic sphere, enabling financial actors to extract value from households while exposing households to various risks and subjecting them to financial calculation and self-discipline. At the same time, overindebtedness, predatory lending, and evictions and other debt collection practices have become subjects of intense public debates and targets of challenges from social movements and political parties, all of which contributes to an unprecedented politicization of finance as such.

For anthropologists with their traditional focus on everyday life and the local level, household debt offers an important lens that allows them to observe the seemingly abstract process of financialization ethnographically. A growing body of anthropological scholarship is documenting the experiences and strategies of debtors, the practices of lenders, and the debates and struggles over debt. Building on and expanding Marek Mikuš’s earlier research as a member of the Financialisation Research Group in the Department ‘Resilience and Transformation in Eurasia’, this new research group will conduct the first comparative ethnographic study of household debt in Eastern Europe to fill three gaps in the existing scholarship:

- First, the group will explore the roles of money in Eastern European lending practices in order to understand how money functions as a special kind of commodity embedded in unequal social and geographic relations.

- Second, the project will document the relationships between debt and risk – the ways in which debt introduces various kinds of risk to households and in which households come to manage and understand risk as a result.

- Finally, the group will study the politics of household debt, conceived broadly such as to include activism, party politics, and public policy.

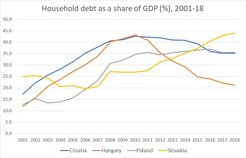

The research group covers four Eastern European countries: Croatia, Hungary, Poland, and Slovakia. After the fall of socialism, all four countries experienced major booms in household debt in the context of what critical economists interpret as specifically peripheral processes of financialization. High-risk and high-cost forms of debt, such as variable-interest and payday loans, were common. In addition, Croatia, Hungary, and Poland had a significant share of foreign-currency loans, among which Swiss-franc loans turned out to be particularly problematic. In Croatia and Slovakia, practices of debt collection became highly controversial. These and other developments led to previously unseen politicizations of household debt, which were often more reformist and conservative than the more familiar Western anti-debt movements, as well as rolling out of government policies intended to manage the consequences of debt. Researchers will use (participant) observation, interviewing, and survey methods to study these multiple facets of household debt, including the experiences of debtors and lenders, the political projects of debtor movements, and state-sponsored processes such as personal bankruptcy proceedings and financial education courses. Drawing on ethnography and a historical anthropological approach, “Peripheral Debt” will develop a comprehensive account of the postsocialist Eastern European experience of household debt and consider what lessons it offers for the study of household debt and financialization in general.

Top photo © Henryk Borawski under CC BY-SA 3.0 licence, cropped